Every household in Maastricht needs to pay local taxes to the municipality for waste disposal and water use. Many students will qualify for kwijtschelding (Dutch for ‘waiver’), which essentially lowers the cost of the tax you must pay.

IMPORTANT: kwijtschelding is only possible for tax assessments that have not yet been paid (or have not been paid more than 3 months ago).

BsGW

The Belastingsamenwerking Gemeenten en Waterschappen (BsGW) is in charge of collecting the taxes on behalf of the municipality. You’re supposed to receive the yearly bill (in letter form) sometime in the first half of February, although the BsGW has been somewhat erratic lately, and people have been receiving their bills at random times of the year.

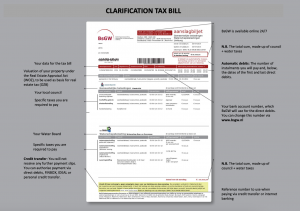

The letter looks like this:

You can use the above image to translate the letter, which is in Dutch, to English.

Usually, the resident of the household that has been registered there longest will receive the letter under his/her name; however, all residents of the household should split the bill equally. Before you pay the bill, however, check whether you’re eligible for kwijtschelding; if you are, you can save money on these taxes.

There is a difference between the process of applying for the kwijtschelding for the first time compared to applying for it again.

First-time kwijtschelding application

Requirements

The BsGW assesses your situation when deciding whether to grant the waiver; they mainly look at your assets and income. If you are a single-person household, you are allowed to have:

- Up to €2,200 in savings in your bank account

- A car or other motorized vehicle (with a value of more than €3,350)

Your income will affect the amount of the waiver you receive; the BsGW does this calculation themselves, so we cannot tell you exactly what the result will be.

You can apply online here or via letter. If you are having trouble with your BsGW kwijtschelding application, you can call them at 088-8420420 (Monday to Friday 9.00-17.00) or reach out to the International Student Helpdesk (ISH).

https://www.youtube.com/watch?v=22t2a900GCk

Re-applying for kwijtschelding

- If you have applied for kwijtschelding in previous years you will have to follow a different process, which mostly involves uploading the relevant documents to prove your low-income status.

When will I receive an answer from the BsGW?

You’ll have to wait 12 weeks for your application to be processed and will receive the decision by mail. During this time your payment obligations will be suspended!